![]()

A Spending Plan gives you a framework for how and where to spend your money in order to achieve your goals and live your life in alignment with your values.

Want some background on how to create a Spending Plan? Read this post, which discusses:

- The top 2 reasons to create and follow a spending plan (one is definitely not what you think!);

- A step-by-step guide on how to make a personalized spending plan;

- Questions to ask yourself as you create your spending plan; and

- Tips and tricks for making a spending plan work for you.

Review of Last Year’s Plan

In 2017, I paid off $27,000 in student loans, saved $17,000, and limited my expenses to $950 per month (you can read the full breakdown here). These were amazing financial accomplishments that were fully aligned with my financial and lifestyle goals. Still, my spending ended up being pretty different than my plan in some categories – and that’s OK!

I use my spending plan as a compass; it points me in the right direction.

The path I wander to get to my destination (in this case paying off student loans and saving an emergency fund) may vary year-to-year. In fact, the destination itself may also vary each year. Still, having a compass in my hand helps me travel in the direction of my goals, regardless of the bumps along the way.

Quarterly Reviews

On a quarterly basis, I check my progress with regards to my yearly allocation using my Spending Plan spreadsheet. Going back through my quarterly reviews helps me develop my annual spending plan, but it also is very helpful for checking in periodically during the year to make sure I am on track. You can see the Quarterly reviews for 2017 here:

- Q1 2017 Financial Review – $2,072 of Student Loans Paid Off

- Q2 2017 Financial Review – $21,500 of Student Loans Paid Off

- Q3 2017 Financial Review – $4k of Student Loans Paid Off + $5k Emergency Fund Saved

- Q4 2017 Financial Review – I saved $11,400 in 3 months!

- 2017 Review – $27k Student Loans Paid Off + 17k Saved + $950 Spent Per Month

Start With a Goal

The most important thing to decide when creating your spending plan for the new year is what your overarching financial goals are. Do you want to save an emergency fund? Start investing in your 401k? Max out your retirement accounts? Save for a downpayment on your first rental property? Pay off all of your student loans? All of the above (OK, tiger)? You get the idea. The sky is the limit.

This goal will inspire you to stick to your spending plan, and it will drive you to figure out more creative ways to cut expenses in areas that aren’t important to you while increasing your earnings and savings rate.

Personally, my driving goal in 2017 was to pay off all of my remaining high interest student loans. Since I crushed that AND the goal I intended for this year – saving a 10k emergency fund – I needed something new to aim for. Getting my net worth into the positive – or at least $0! – sounds like a daunting (dare I say, unachievable goal) in the face of the 100k of debt that I had just two and a half years ago. However, given the financial progress I’ve made (check out my quarterly reports below) in the past 2+ years, I’m fairly sure I can break through to a positive net worth by December 31st of this year. That’s my goal. My “Big Hairy Audacious Goal” (BHAG) is to not only be positive by the end of the year, but to have over a +$50,000 saved or invested by the end of the year. I estimate that should land me at an approximate $15,000 net worth.

Align Plan and Values

I revisited my goals for the year and aligned my spending categories and my goals (short-term and long-term). For example, to maintain my health through physical activity, I’ve planned to spend money on Sports; to encourage myself to pursue self-improvement, I’ve allocated $200 to spend on apps and journals and classes, etc; to give myself permission to hire professionals to assist with my financial planning, I’ve planned to spend money to hire a CFP and/or CPA.

A Spending Plan is a guideline that helps you spend your money in accordance with your values.

2018 Spending Plan

Student Loans

Low Interest Loans Minimum Payment – $2,645

Total Loans = $2,645

My payment plan changed this year from an income driven repayment plan to a pay as you earn plan. Due to my income, I no longer qualified for partial financial hardship which was needed for the IDR plan. Therefore my payments became nearly 5 times larger!

As I’ve discussed before, I am paying only the minimums on my low interest student loans, with interest rates between 3.5% and 4.6%, because I can get a better return on investment by investing in the stock market, and I will also get additional tax benefits from investing in my 401k and IRA. In the end, that means my net worth will grow faster than if I focused on paying off my student loans.

Investing Goals

401k – $18,500

IRA – $5,500

Total Investing = $24,000

2018 is the year I will start investing!! How exciting. I’m planning to put the money saved last year towards my 2017 traditional (pre-tax) IRA.

Savings Goals

Tiny House – $15,000

Total Savings = $17,000

2018 is a year of saving and planning for my alternative housing idea – living in a tiny house. I plan to construct this house myself for a cost of about $25,000. While I’m saving, I’ll begin designing the house (with the help of my partner, who happens to be an engineer).

Expenses

Enjoying Life – $2,640

Experiential – $480

Travel – $1,000

Sports – $360

Watersports & Longboard – $500

Boat – $100

Self-Improvement – $200

Projects – $295

Microhouse – $295

Food & Alcohol – $600

Dining – $360

Alcohol – $240

Shared Expenses – $6,120 (half of this is my personal spending)

Experiential – $480

Dining – $480

Alcohol – $480

Groceries – $3,240

Household – $240

Rent/Home Improvement – $1,200

Business – $1,125

Blog – $120

Educational – $900

Technological – $105

Automotive – $2,254

Fuel – $0

Maintenance – $504

Tolls/Parking – $550

Car Insurance & Registration – $1,200

Objects – $640

Personal Care – $120

Household – Non-Consumable – $120

Clothing – Necessary – $100

Clothing – Unnecessary – $50

Gadgets – $150

Gear – $100

Misc – $1,570

Health – $500

Financial Planning Services – $700

Charity/Donations – $100

Gifts – $100

Work Expenses – Unreimbursable – $50

Tax – $0

Slush – $120 (This is what I call money that I have spent in cash but I don’t know in what category)

Total Expenses = $12,184*

Total Expenses + Loans = $53,830*

*These amounts include only 50% of the Shared Expenses category above

Final Thoughts

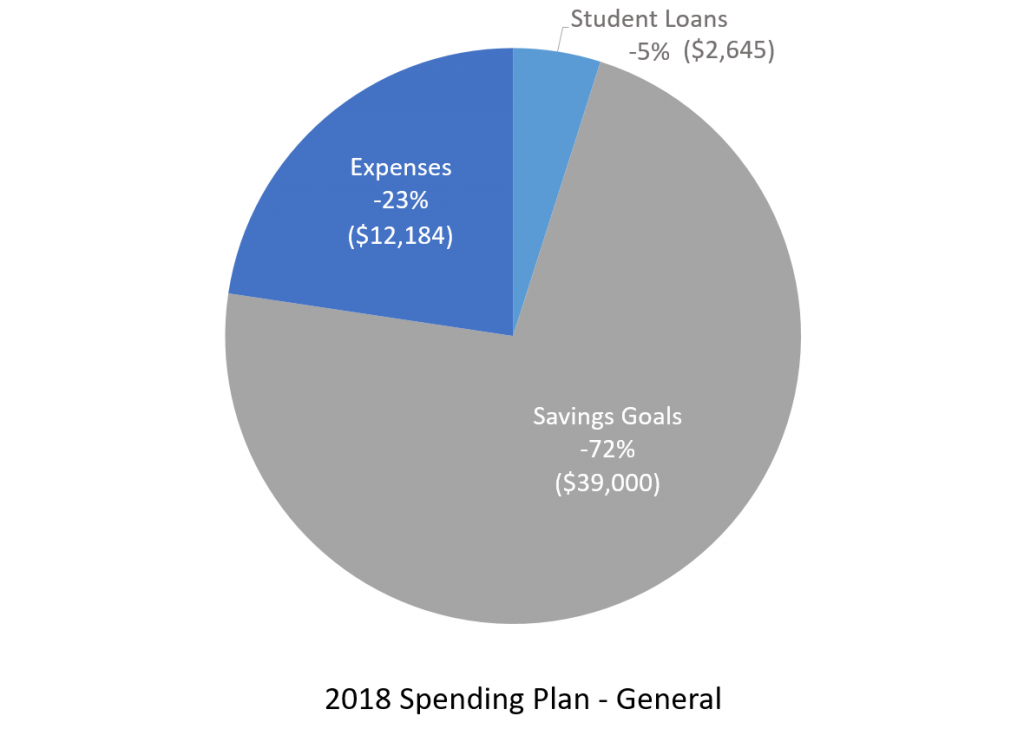

I always review my final spending plan for the year with one specific goal: ensure it is aligned with my priorities and values. Using pie charts, such as those above, make this exercise visual and straightforward. The general chart shows that I am putting 77% of my anticipated spending towards building wealth and increasing my net-worth. The remaining 23% is living expenses, which sit at around $1,000 per month. That is a level of living expenses that I am very comfortable with.

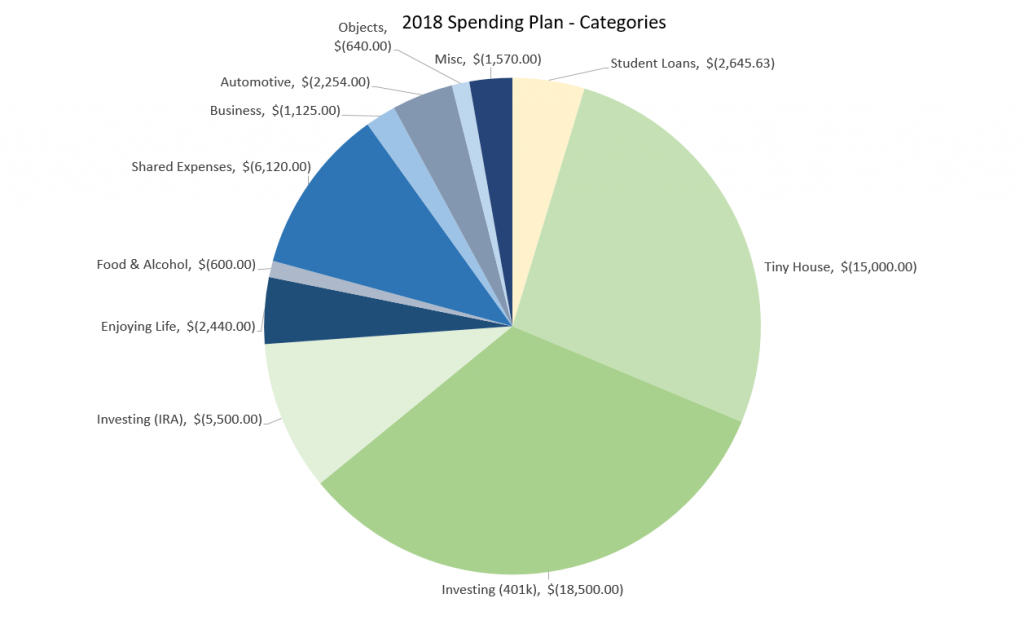

In fact, $1,000 a month feels downright luxurious when I look at the categories chart. This chart shows me that I’m giving myself permission to spend a lot on enjoying life and travel, while setting lower limits for my objects and misc spending. Also, I’m bearing in mind that the chart is showing the full Shared Expenses amount, while I am only responsible for half of those expenses.

Overall, this year I plan to make huge strides towards accomplishing my financial goals, and my spending plan will be my road map to reaching those goals. I will kickstart my investments, and I should be able to bring my net worth into the positive. You’d never think someone could be so happy at the prospect of having $0!

Your Turn:

What does your spending plan look like for this year? What percentage of saving/investing to expenses do you anticipate?

WANT TO REMEMBER THIS? SAVE THESE TIPS TO YOUR FAVORITE FINANCE PINTEREST BOARD!

[…] Spending Plan 2018 – Save $15k, Invest $24k, Live on $1k per Month […]

[…] Spending Plan 2018 – Save $15k, Invest $24k, Live on $1k per month […]

[…] left too much wiggle room in the spending plan for my taste. My final spending amounts helped me decide on hard numbers for my previously TIAIC […]

[…] Spending Plan 2018 – Save $15k, Invest $24k, Live on $1k per month […]